Bruce Tyson: His Biography and Financial Success Story

Early Life and Background

Bruce Tyson was born on December 1, 1950, in the United States. His early life was characterized by an environment that promoted education and discipline. Coming from a middle-class family, he was raised with strong moral values and the belief that hard work was the key to success. These foundational principles guided his future career in finance.

Biography

| Field | Details |

| Full Name | Bruce Tyson |

| Date of Birth | December 1, 1950 |

| Place of Birth | United States |

| Nationality | American |

| Profession | Financial Expert, Investment Manager |

| Education | University of Southern California |

| Famous For | Marriage to Shelley Long, Financial Career |

| Company | Founder of Tyson Management |

| Marital Status | Divorced (Shelley Long, 1981–2004) |

| Children | One (Juliana Tyson) |

| Net Worth | Estimated $20 million |

| Philanthropy | Contributions to education and financial literacy causes |

| Key Investments | Technology, real estate, blue-chip stocks |

| Current Status | Semi-retired, involved in mentoring young professionals |

Educational Background

Tyson displayed exceptional academic talent from a young age. After completing high school, he attended the University of Southern California, where he earned a degree in business and finance. His academic performance at USC was exemplary, and he quickly made a name for himself among peers and professors for his sharp analytical mind and deep understanding of financial systems.

Career Beginnings

After graduating, Bruce Tyson began his career in the investment world in the early 1970s. He started as a financial consultant for a small firm, where he honed his skills in analyzing market trends and making sound investment decisions. Early in his career, Tyson showed a keen ability to identify lucrative investment opportunities, setting the stage for his future success.

Rise in the Financial World

In the 1980s, Bruce Tyson’s career took off. He joined a prominent financial firm, where his expertise in portfolio management earned him recognition. His approach was characterized by a mix of conservative and bold investment strategies, making him a reliable figure in the financial industry. As he climbed the ranks, he took on more significant roles, managing portfolios for high-net-worth individuals and institutional clients.

Tyson Management Firm

In the mid-1990s, Bruce Tyson founded his own investment management company, Tyson Management, which focused on wealth management services for affluent clients. His firm quickly gained a reputation for offering tailored financial advice and delivering consistent returns. Under his leadership, Tyson Management expanded its client base and became a well-respected entity in the world of investment.

Notable Investments

Bruce Tyson has been involved in several high-profile investments throughout his career. He is known for his long-term, growth-oriented investment philosophy, which emphasizes diversification and risk management. Some of his most notable investments include key positions in technology, real estate, and blue-chip stocks. His strategic approach has allowed him to build a robust and diverse portfolio over the decades.

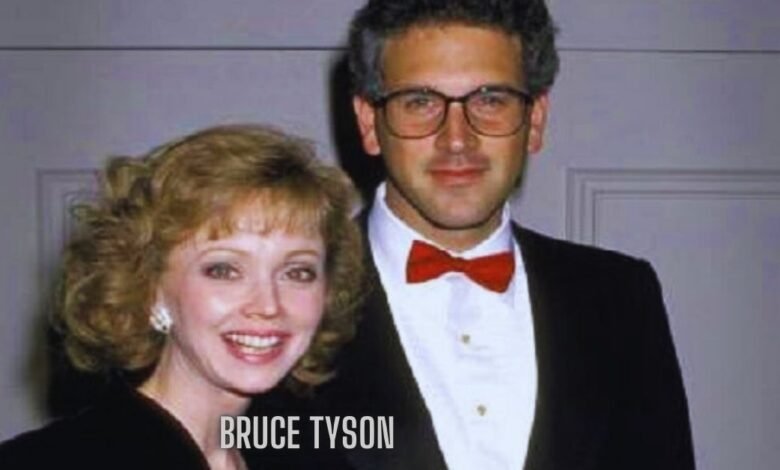

Marriage to Shelley Long

Bruce Tyson’s marriage to actress Shelley Long, famous for her role in the television show Cheers, brought him into the public eye. The couple married in 1981 and were seen as a power couple, balancing their lives between Hollywood and the financial world. Despite his financial success, Tyson was often overshadowed by Long’s fame in the entertainment industry.

Impact of His Marriage on Public Perception

While Tyson maintained a relatively low public profile compared to his wife, his association with Shelley Long enhanced his visibility in certain circles. Their marriage placed him in the spotlight, often drawing attention to his personal life rather than his financial achievements. However, Tyson handled the attention with grace, maintaining his professional reputation while supporting his wife’s acting career.

Philanthropy and Social Contributions

Aside from his career, Bruce Tyson has been actively involved in philanthropy. Over the years, he has contributed to various charitable causes, particularly those related to education and financial literacy. Tyson believes in giving back to society, and his philanthropic efforts reflect his commitment to making a positive impact on the lives of others.

Personal Life Post-Divorce

After more than two decades of marriage, Bruce Tyson and Shelley Long divorced in 2004. The divorce was amicable, with both parties maintaining mutual respect. Post-divorce, Tyson kept a low profile, focusing on his career and personal growth. He continued to build his wealth and remained dedicated to his work in the financial sector, avoiding the media spotlight as much as possible.

Bruce Tyson’s Influence on Financial Markets

Bruce Tyson has had a significant influence on the financial markets through his investment strategies and market insights. His ability to navigate market volatility and predict economic trends has made him a sought-after consultant and advisor. Many of his peers in the financial industry look to him for guidance, particularly during periods of economic uncertainty.

Net Worth Breakdown

Bruce Tyson’s net worth is estimated to be around $20 million, primarily derived from his successful career in finance and investment management. Over the years, his wealth has grown through various channels, including salary, bonuses, and investment returns. His steady approach to wealth management has allowed him to accumulate a substantial fortune.

Tyson’s Financial Strategies

Bruce Tyson’s financial strategies revolve around disciplined investing, long-term growth, and risk management. He advocates for a balanced portfolio that includes a mix of equities, bonds, and alternative assets. His focus on research and due diligence has enabled him to make informed investment decisions, minimizing risk while maximizing returns.

Public Appearances and Interviews

Throughout his career, Bruce Tyson has kept a low profile when it comes to public appearances. However, he has occasionally given interviews to financial publications, sharing his insights on market trends and investment strategies. These rare appearances have reinforced his reputation as a knowledgeable and prudent investor.

Retirement and Current Ventures

Although Bruce Tyson has stepped back from day-to-day operations at Tyson Management, he remains involved in strategic decisions. His semi-retirement has allowed him to enjoy more personal time while still maintaining a presence in the financial world. He continues to offer advice to select clients and is involved in mentoring the next generation of financial professionals.

Legacy and Long-term Impact on Finance

Bruce Tyson’s legacy in the financial world is one of integrity, expertise, and disciplined investing. His contributions to the industry, particularly in wealth management, have left a lasting impact on how investors approach long-term growth and risk management. His financial strategies continue to influence both new and seasoned investors, ensuring that his legacy endures in the world of finance.

Conclusion

Bruce Tyson’s journey from a financial consultant to a highly successful investment manager is a testament to his hard work, discipline, and financial acumen. While he may be more publicly known for his marriage to Shelley Long, his career in finance stands on its own as a remarkable achievement. Tyson’s approach to investing, combined with his philanthropic efforts, ensures that he remains a respected figure in both the financial world and beyond.

Read More: Simplifying 401(k) Administration for Your Business